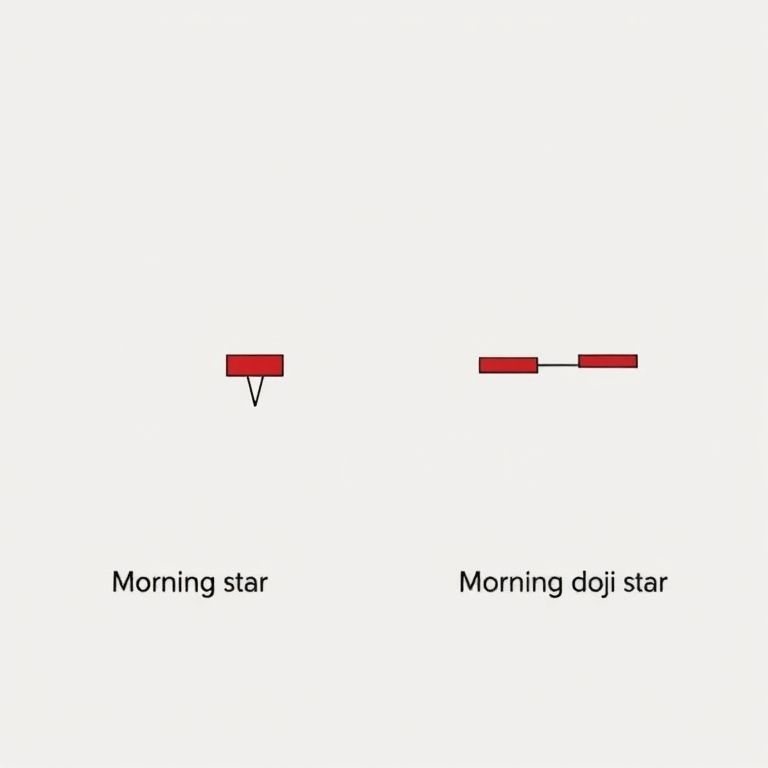

Difference between morning star candle and morning doji star

Difference Between Morning Star Candle and Morning Doji Star

Introduction

Trading mornings feel like a fresh start: a chart cleans itself up, a trend loosens its grip, and candlesticks whisper where the price might go next. The morning star family—especially the classic morning star and the morning doji star—is a familiar signal many prop traders lean on to anticipate bullish reversals after a downtrend. But what exactly sets these two apart, and how should a modern trader use them across assets like forex, stocks, crypto, indices, options, and commodities?

What Morning Star and Morning Doji Star Are

- Morning Star: A three-candle pattern that hints at a shift from selling pressure to buying interest. The first candle is a long bearish one, the second is a small-bodied candle that gaps down, and the third is a long bullish candle that closes above the midpoint of the first candle. It’s a progress signal: down momentum fading, buyers stepping in.

- Morning Doji Star: Similar structure, but the middle candle is a doji, signaling stronger indecision. If the third candle still closes above the first candle’s midpoint, the reversal premise holds, but traders often treat the doji version as a more cautious confirmation.

Key differences at a glance

- Middle candle trait: standard morning star uses a small-bodied candle; morning doji star places a doji there, signaling more market hesitation before the turn.

- Signal strength: the doji variant can feel more conservative—validators want more price action to confirm shifts in sentiment, which can matter in choppier markets.

- Gap dynamics: both rely on a setup that suggests buyers are gaining the upper hand, but the doji version can tolerate a tighter price action if the third candle still closes compellingly.

Trading them in practice

- Confirm with volume: rising volume on the third candle strengthens the reversal case.

- Use other indicators: pairing with RSI, MACD, or trend lines helps avoid false starts.

- Trade setup and risk: wait for the third candle close, place stops below the low of the first candle, and size risk to your plan rather than the pattern alone.

- Multi-asset relevance: these patterns appear across forex, stocks, crypto, indices, options, and commodities, but liquidity and volatility will shape where they work best.

Why this matters for prop trading and beyond

- Across asset classes, the patterns teach disciplined entry timing and risk management, two pillars in prop desks where capital is tight and edge matters.

- In practice, you’ll see these signals play out differently in fast-moving crypto vs. steady FX ranges. The core takeaway is the same: a potential dawn of bullish momentum after a down leg, but never rely on a single candle; corroborate with price action and context.

DeFi, smart contracts, and AI: modernization on the horizon

- Decentralized finance is accelerating with smart contracts that automate risk controls and order routing, yet faces liquidity fragmentation and security hurdles.

- AI-driven analytics promise quicker pattern recognition and risk scoring, while still requiring human oversight to avoid overfitting in noisy markets.

Prop trading’s future and a couple of slogans

- The edge today is synthesis: combine classic candlesticks like morning star/doji star with real-time data, capital access, and robust risk rules.

- Slogans: “Dawn signals, smart trades.” “Morning stars: clarity at the dawn of a move.” “From star to strategy—transforming patterns into probabilities.”

Practical idea: treat morning star and morning doji star as catalysts, not guarantees. Use them to frame a plan, then let volume, momentum, and your risk controls decide the next move.